Caldas Total Insights

Your go-to source for the latest news and informative articles.

Whole Life Insurance: The Policy That Lasts as Long as Your Family Drama

Discover how whole life insurance can protect your family through thick and thin—because your legacy deserves more than just drama!

Understanding Whole Life Insurance: How It Provides Stability Amid Family Changes

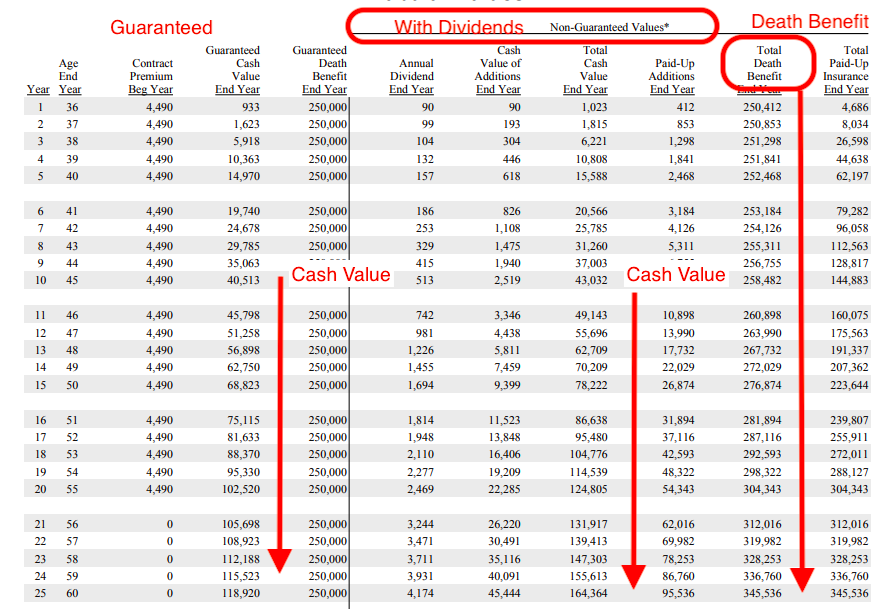

Understanding Whole Life Insurance is crucial when considering how to provide financial stability for your family through various life changes. This type of insurance not only offers a death benefit but also accumulates cash value over time. As your life circumstances evolve—such as marriage, the birth of children, or career changes—having a whole life insurance policy can serve as a safety net. It ensures that your loved ones are supported financially, regardless of unexpected events. For more insight into its benefits, you can read more about it on Investopedia.

Furthermore, the stability provided by whole life insurance can be particularly valuable during transitional periods. With the guarantee of lifelong coverage and predictable premiums, families can plan their finances with confidence. Additionally, the cash value component offers the flexibility to borrow against it for emergencies or major expenses, providing peace of mind. To explore the nuances of using whole life insurance as a financial tool, check out NerdWallet.

5 Key Benefits of Whole Life Insurance for Families Facing Uncertainty

Whole life insurance provides a layer of security for families facing uncertainty, particularly in challenging financial situations. One key benefit is its guaranteed death benefit, which ensures that your loved ones are financially protected in the event of your passing. This financial safety net can help cover immediate expenses, such as funeral costs and outstanding debts, allowing families the time they need to adjust. Moreover, unlike term life insurance, whole life policies do not expire, which means this protection is available for your entire lifetime.

Another significant advantage of whole life insurance is the cash value accumulation. This feature allows policyholders to build savings that they can access during their lifetime, providing liquidity in times of need. Families facing unexpected challenges, such as medical emergencies or job loss, could benefit from this cash value as a resource. Additionally, in contrast to mutual funds or savings accounts, the growth of cash value in whole life insurance is typically stable, making it a low-risk investment for families looking for long-term financial security.

Is Whole Life Insurance Right for Your Family? Answering Common Questions

When considering whether whole life insurance is right for your family, it's essential to understand the concept of lifelong coverage. Unlike term life insurance, which provides protection for a specific period, whole life offers a policyholder a guaranteed death benefit as long as premiums are paid. Additionally, whole life policies accumulate cash value over time, which can serve as a financial asset for your family. For more insights on how these policies work, check out this detailed explanation from Investopedia.

Before making a decision, it's crucial to assess your family's financial needs and goals. Here are some common questions that may aid in your evaluation:

- What are the long-term financial goals for my family?

- Will my family need funds for estate planning or college expenses?

- How stable is our income, and can we afford the higher premiums associated with whole life insurance?

Taking the time to explore these questions can help you determine if whole life insurance is a suitable choice. For further information, you can visit NerdWallet.