Caldas Total Insights

Your go-to source for the latest news and informative articles.

Beyond Cash: Navigating the World of Digital Wallet Integrations

Explore digital wallet integrations and discover how they're reshaping transactions! Unlock convenience and smart tips for a cashless future.

Understanding Digital Wallets: How They Work and Why They Matter

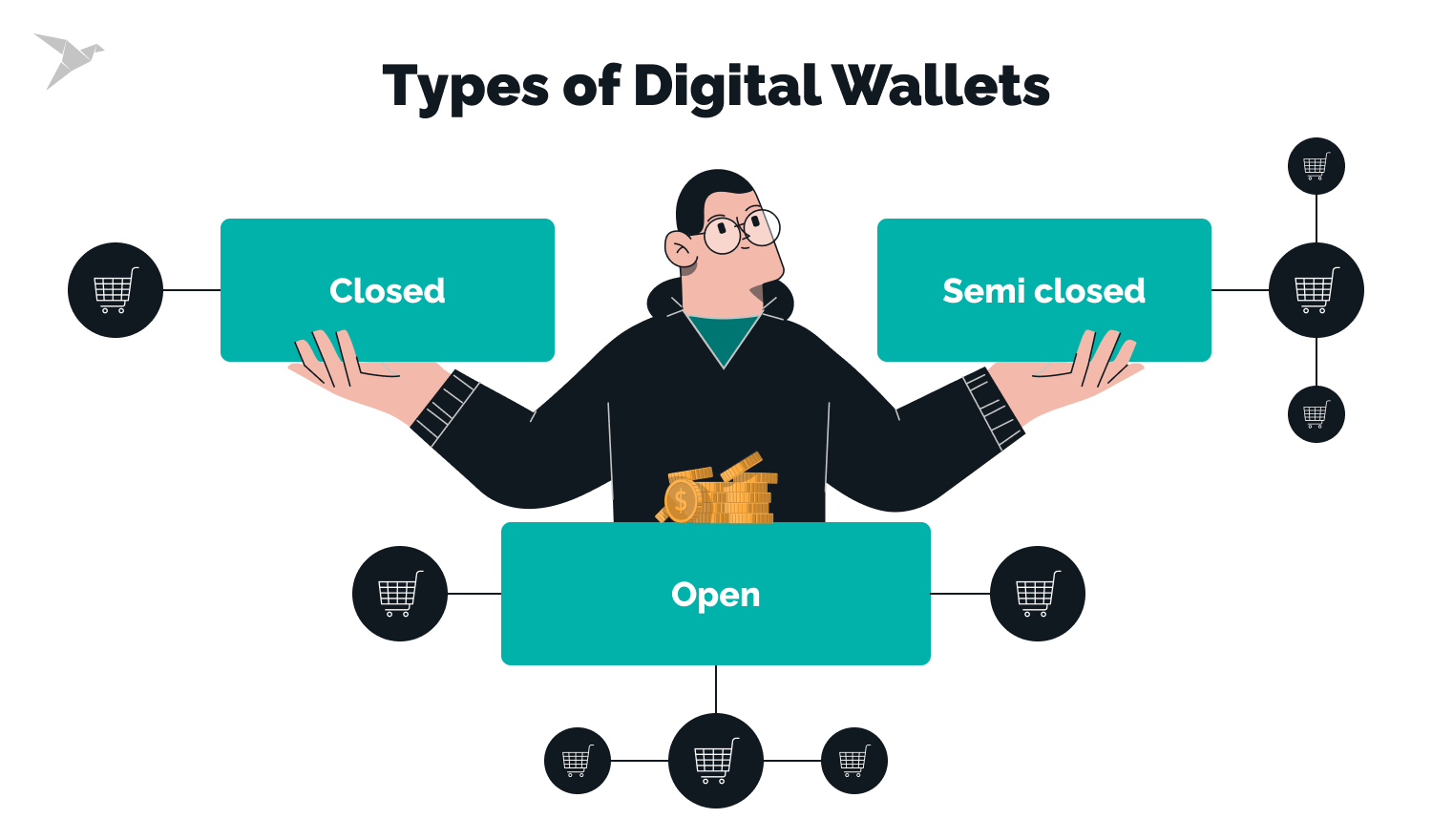

Understanding Digital Wallets is essential in today’s fast-paced digital economy. A digital wallet, or e-wallet, is a software application that enables users to store and manage their payment information securely. Users can link their credit or debit cards, bank accounts, and even cryptocurrencies, allowing for seamless transactions both online and in physical stores. Digital wallets utilize encryption technology to ensure the security of sensitive information, making them a convenient and safe method for making purchases. Major platforms like PayPal, Apple Pay, and Google Wallet have revolutionized the way people handle their financial transactions.

There are several reasons why digital wallets matter in today's society. Firstly, they offer unmatched convenience; with a few taps on your smartphone, you can complete transactions without fumbling for cash or cards. Additionally, many digital wallets integrate with loyalty programs, providing users with rewards and discounts. Moreover, they enhance security by minimizing the number of physical cards you carry, reducing the risk of theft. Understanding how these wallets operate and their benefits can help consumers make informed choices about their personal finance management.

Counter-Strike is a popular multiplayer first-person shooter game that pits teams of terrorists against counter-terrorists in a variety of game modes. Players can engage in competitive matches, casual play, or even battle royale formats. If you're looking to enhance your gaming experience, consider checking out the betpanda promo code for exclusive offers.

The Future of Payments: Exploring Digital Wallet Integrations Across Industries

The rapid evolution of technology has brought forth a revolution in the payments landscape, with digital wallet integrations leading the charge across various industries. As consumers increasingly prefer seamless, contactless transactions, businesses are recognizing the need to adapt to this shift. From retail to hospitality, industries are harnessing the power of digital wallets to enhance customer experience. Major players like Apple Pay, Google Wallet, and Samsung Pay have set the stage for the integration of digital wallets into point-of-sale systems, encouraging a surge in mobile transactions that benefits both consumers and merchants alike.

Moreover, the adoption of digital wallet integrations is not limited to traditional retail. In the healthcare sector, for example, patients can now pay bills and manage their expenses through secure wallet applications, promoting financial convenience and transparency. Similarly, the global e-commerce market is experiencing a surge in digital wallet usage, with features like one-click payments and loyalty rewards enhancing customer engagement. As companies across sectors adopt these payment solutions, it is clear that embracing digital wallet integrations will be essential for staying competitive in today’s fast-paced market.

10 FAQs About Digital Wallets: What You Need to Know Before Adopting

Digital wallets have revolutionized the way we handle transactions, making them faster and more convenient. If you're considering adopting a digital wallet for your financial needs, you might have questions about how they work and their benefits. Here are 10 FAQs to help you get started. First, what exactly is a digital wallet? A digital wallet is a software application that securely stores your payment information and passwords for numerous payment methods and websites. It allows you to make transactions directly from your device without the hassle of cash or physical cards.

Another common question is about the security of digital wallets. Are they safe to use? Most digital wallets use advanced encryption and security measures to protect your information. Additionally, many offer features like two-factor authentication and biometric access, making them even more secure. However, it's essential to choose reputable providers and be cautious of potential phishing scams. Overall, adopting a digital wallet can streamline your payment process while providing enhanced security, but it’s crucial to understand the risks and features before making the switch.