Caldas Total Insights

Your go-to source for the latest news and informative articles.

Valuations After Market Drop: The Silver Lining in the Clouds

Discover how market drops unveil hidden opportunities in valuations and turn clouds into silver linings for smart investors.

Understanding the Impact of Market Drops on Valuations: A Deep Dive

Market drops can significantly influence company valuations, affecting everything from investor sentiment to financial metrics. When a market experiences a downturn, valuations may decrease sharply as investors reassess risk and future earnings potential. This often leads to a ripple effect where businesses are forced to adjust their strategies to maintain investor confidence. Understanding the impact of market drops is crucial for stakeholders, as it helps them navigate through economic uncertainties and make informed decisions regarding investments and corporate strategies.

Moreover, the relationship between market fluctuations and valuations is not merely about immediate financial metrics; it also encompasses long-term implications for growth prospects. For instance, a decline in valuations during a market drop can lead to a reevaluation of mergers and acquisitions, as companies might hesitate to pursue strategic growth opportunities in a volatile environment. To illustrate, here are some key factors to consider during market declines:

- Investor Confidence: Market dips often result in diminished investor sentiment.

- Future Earnings Potential: Analysts frequently recalibrate earnings forecasts in light of declining stock prices.

- Strategic Adjustments: Companies may alter their operational strategies to adapt to changing market conditions.

In summary, comprehending how market drops affect valuations cannot be overstated, as these dynamics play a pivotal role in shaping a business's trajectory in both the short and long term.

Counter-Strike is a highly competitive first-person shooter game that has captivated millions of players around the world. The game is known for its strategic gameplay, where teams of terrorists and counter-terrorists face off in various objectives. Recently, the skin market recovery has become a hot topic among fans, as players discuss the fluctuating values of in-game items.

How to Find Investment Opportunities in a Down Market

Finding investment opportunities in a down market requires a strategic approach. First, it's essential to analyze market trends to identify sectors that may withstand economic downturns. Look for industries that are resilient, such as utilities, healthcare, or consumer staples. Additionally, consider utilizing screening tools or platforms that aggregate stock data, allowing you to filter by performance metrics during recessions. By focusing on these stable sectors, you can uncover potential investment options that are likely to rebound when the market regains strength.

Another successful strategy involves shifting your perspective on value. In a down market, many reputable companies may see their stock prices plummet, creating a buying opportunity for savvy investors. Make use of fundamental analysis to assess the underlying strength of a company, looking at factors like earnings, revenue growth, and market position. Moreover, don’t overlook alternative investments such as real estate or commodities, which can provide diversification and potential returns when traditional stock markets are volatile. By adopting a multifaceted approach and being patient, you’ll enhance your chances of finding lucrative investment opportunities even in challenging economic conditions.

Is the Market Drop an Opportunity? Insights on Valuations and Future Growth

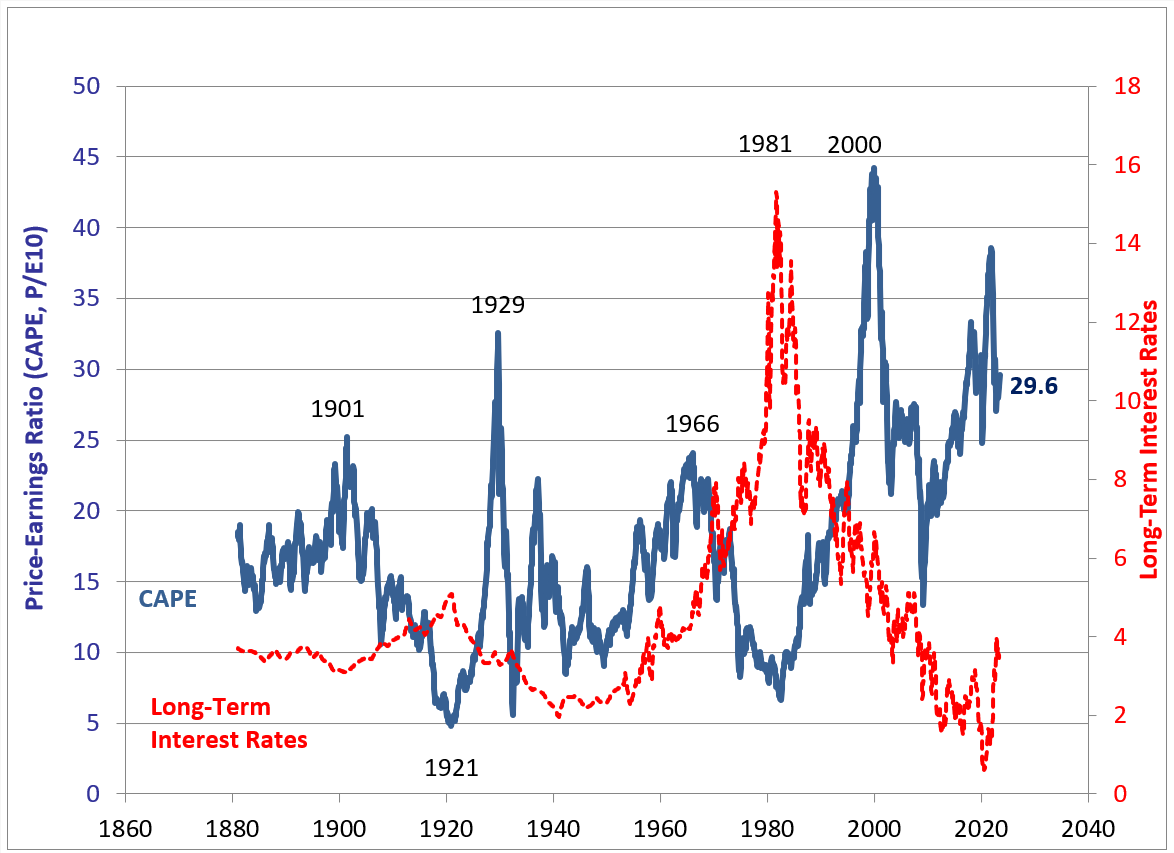

The recent market drop has left many investors pondering whether this presents a valuable opportunity or signals further decline. While valuations may appear lower than their historical averages, it’s essential to analyze the underlying factors contributing to these changes. In recent years, substantial advancements in technology and shifts in consumer behavior have created a landscape ripe for growth. Investors should consider conducting a deep dive into selected sectors that have demonstrated resilience, as certain industries are bound to recover quicker than others.

Additionally, future growth potential is often found in companies that are undervalued during market corrections. Historical data suggest that markets tend to rebound strongly after downturns, providing savvy investors with opportunities to buy into stocks that are temporarily priced lower. To capitalize on this, consider developing a list of companies with strong fundamentals, competitive advantages, and a track record of innovation. As Warren Buffett famously stated, “Be fearful when others are greedy, and greedy when others are fearful.” The current market conditions may just be the chance you’ve been waiting for.